Palm shares slide with its revenue expectations falling well short of Wall Street expectations

By APFriday, March 19, 2010

Ahead of the Bell: Palm share slide

NEW YORK — A number of industry experts are raising doubts about the ability of Palm Inc. to turn itself around in an increasingly crowded smartphone market.

The company’s shares slid 15 percent, or 87 cents, to $4.78 ahead of trading Friday.

“We are less confident in the company’s prospects as an ongoing concern,” Kaufman Bros. analyst Shaw Wu told investors in a note Friday. Wu cut his rating on Palm’s stock to “Sell” from “Hold.”

He said Palm will either have to sell itself off or raise more capital to avoid running out of money.

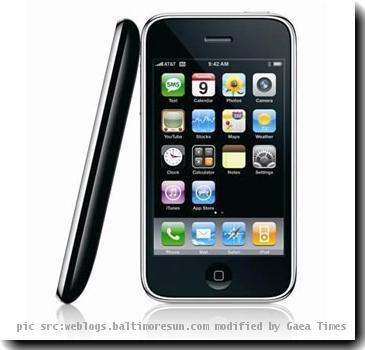

Wu also reiterated a “Buy” rating on Apple Inc. and Research in Motion Ltd., whose iPhones and BlackBerrys blocked Palm in its efforts to reclaim market share.

Palm said Thursday it shipped 960,000 smart phones in the quarter ended Feb. 26, but customers only bought 408,000, down 29 percent from the quarter before. Apple sold 8.7 million iPhones in the latest quarter.

In a client note, Deutsche Bank’s Jonathan Goldberg cautioned against “getting overly negative,” keeping his “Hold” rating on the stock.

“If the company can meaningfully reduce its cash burn, they may be able to eke along in survival mode long enough to improve their trajectory,” he said.

But Goldberg also warned that bad news could beget more bad news. “A poor showing at Sprint and Verizon, has doused interest from other carriers including AT&T and Vodafone,” he said.

More carriers generally means more potential customers, which Palm desperately needs. The company said Thursday it expects revenue of $150 million this quarter, about half what analysts polled by Thomson Reuters were looking for. The shortfall comes in part because carriers have already built up inventories of its Pre and Pixi smart phones that they still have to sell.