At a glance, how tech industry earnings have reflected a rebound in spending

By APWednesday, July 28, 2010

A look at recent tech-industry earnings

Here is a summary of recent earnings reports for selected technology companies and what they reveal about the state of spending and the overall economy:

July 13: Intel Corp. reports its largest quarterly net income in a decade as the chipmaker benefits from a stronger computer market and more sophisticated factories. Large corporations bought more computers that use Intel’s most expensive chips, a sign that businesses aren’t as stingy on upgrading employees’ personal computers.

July 15: Advanced Micro Devices Inc. reports a smaller second-quarter loss after reviving sales of computers that use its chips and undergoing a wrenching years-long effort to shed costs. AMD would have made money were it not for a loss related to its investment in factories it used to own but were spun off into a separate company a year ago.

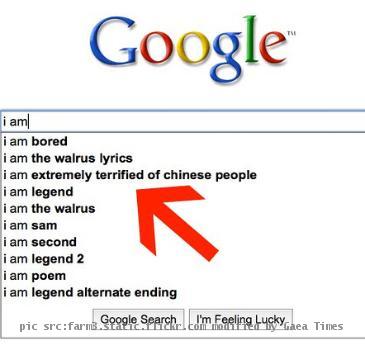

Google Inc.’s earnings misses analysts’ target. The letdown stems from Google’s expanding payroll and a run-up in the U.S. dollar that has been driven by fears that the euro will crumble if governments in Europe default on their perilously high debts.

July 19: IBM Corp. beats earnings expectations in the second quarter and raises its guidance for the year, but reports revenue rising only 2 percent, falling short of Wall Street’s estimates. IBM says currency changes hurt revenue, as deals done in other currencies are now worth less when they’re converted to U.S. dollars.

Texas Instruments Inc. says second-quarter income and revenue jumped as demand continued to recover after the recession. But investors who saw strong reports recently from other technology companies wanted even better results from TI and sent the chip maker’s shares down.

July 20: Yahoo Inc. reports lackluster revenue growth, overshadowing a surge in net income. The company says the second quarter looked fairly strong until June when several large advertisers suddenly reduced their spending. Reflecting that circumspect mood, Yahoo predicts its third-quarter revenue will either remain unchanged from last year or increase by as much as 4 percent.

Apple Inc. says net income in the latest quarter rose 78 percent, thanks to sales of its iPhone and the new iPad tablet computer. And unlike many other technology companies, Apple also saw strong revenue - up 61 percent in the quarter.

July 21: EMC Corp. says net income more than doubled in the second quarter as corporations opened the spigot on spending for more data storage, though its CEO calls the recovery “choppy” and says EMC is “definitely seeing a slowdown” in southern Europe.

Qualcomm Inc. says net income for the most recent quarter rose 4 percent and revenues fell less than analysts expected, allaying concerns among investors that the developer of wireless chips and technologies was failing to capitalize on consumers’ appetites for smart phones.

July 22: Xerox Corp. says net income jumped 62 percent in the second quarter as the company reaped the benefits of its $6 billion acquisition of outsourcer Affiliated Computer Services and notched strong printer sales. It also raises its 2010 guidance. CEO Ursula Burns points to “some signs of life” in spending by large corporations.

Microsoft Corp. says its net income surged in the most recent quarter, the latest sign that businesses are again spending on technology. Strong sales of Windows, particularly to Microsoft’s corporate customers, and of Office 2010 helped boost results.

Amazon.com Inc. says net income jumped, bolstered by shoppers who spent more with the online retailer even as consumer confidence fell overall.

July 28: Corning Inc. posts a sharp increase in its second-quarter earnings because of strong sales of its glass for flat-panel televisions and mobile devices. The company sees “substantial growth opportunities” in LCD glass as LCD television sets start to spread to emerging markets, notably China.

Aug. 11: Cisco Systems Inc. reports a 79 percent increase in earnings in the latest quarter as its customers continued to catch up on delayed purchases of networking gear, but its stock fell as revenue missed Wall Street expectations. CEO says company is seeing signs of the economic recovery slowing down.

Aug. 19: Hewlett-Packard Co. reports that net income jumped 6 percent and revenue notched 11 percent higher in HP’s last full quarter under now-ousted CEO Mark Hurd. But the numbers also show that one of Hurd’s biggest projects - transforming HP into a technology-services powerhouse like IBM Corp. - is progressing slowly, as many companies are hesitant to commit to long-term deals out of fears about the economy. Revenue in the services division, HP’s most profitable, grew just 1 percent to $8.6 billion.

PC maker Dell Inc. says its net income improved 16 percent in the most recent quarter, as companies spent more on servers, storage and computers for employees. But a key measure called gross profit margin fell. The percentage of revenue left after subtracting the cost of making products fell to 16.6 percent from 18.7 percent a year ago. Prices remained high for some PC components, including memory and LCD screens.

Aug. 27: Intel cuts sales forecast for the quarter, citing weaker demand for consumer PCs. Intel says it now expects revenue of $10.8 billion to $11.2 billion for the fiscal third quarter, compared with a previous forecast of $11.2 billion to $12 billion.

Sept. 16: Oracle Corp.’s net income swelled 20 percent in the latest quarter as the world’s biggest maker of database software prospered from freer technology spending by corporations. Its core business is thriving because businesses have pumped up their investments in the programs that run their back offices.

Sept. 21: Adobe Systems Inc. says its net income in the most recent quarter skyrocketed 69 percent, helped by strong sales of Creative Suite 5, the flagship software package that includes Photoshop and Illustrator. However, the company’s revenue outlook for the current quarter fell short of Wall Street’s expectations. Adobe cited slower sales of its design software in the U.S. education market and in Japan.

Tags: North America, Personnel, recession, Target, United States