Motorola posts 4th-quarter profit as costs fall but outlook is below expectations; shares fall

By APThursday, January 28, 2010

Motorola posts 4Q profit but outlook is low

NEW YORK — Motorola Inc. showed progress in its turnaround efforts Thursday but a disappointing profit forecast sent its shares sliding.

Motorola stock fell 88 cents, or 12 percent, to $6.52 in midday trading.

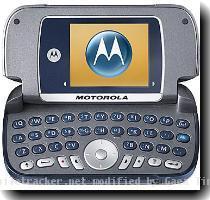

The shares are still more than double what they were trading for in March, as optimism has grown that Motorola can salvage its cell phone business. The first fruits of its new approach, the Cliq and Droid smart phones, went on sale in the fourth quarter.

Those phones were well received, and Motorola reporting shipping 2 million units. But overall cell phone sales were lower than expected, at 12 million units. Total revenue came to $5.7 billion, missing the average forecast from analysts of $5.9 billion, according to Thomson Reuters.

However, analysts did not appear to have taken into account that Motorola deferred $200 million in revenue from sales of smart phones, amortizing it instead over two years, in a new accounting step.

Looking ahead, Motorola said it expects a loss in the first quarter of 1 cent to 3 cents per share, excluding unusual items. Analysts expected a profit of 3 cents.

Motorola co-CEO Sanjay Jha said the loss would come from the planned launch of several new smart phones, with the attendant sales, marketing and support costs. At the same time, he expects smart phone sales to be down from the fourth quarter, when Verizon Wireless put a massive push behind the Droid.

Jha said sales of phones to be used on prepaid services were particularly weak in the fourth quarter. That could be bad news for Sprint Nextel Corp.’s Boost prepaid service, which uses Motorola phones exclusively. Sprint reports fourth-quarter results on Feb. 10.

The Cliq and Droid run Google Inc.’s Android software. Jha said Motorola will provide another phone to Google, which will sell it directly to consumers. Google started selling a phone made by Motorola rival HTC Corp. this month, marking the first time the Web company bypassed the carrier marketing channel.

Motorola’s profits are still propped up by its other two divisions, which make things like police radios and cable set-top boxes, while the phone business loses money. However, Jha said he expects the phone business to become profitable in the fourth quarter this year as Motorola continues to shift its emphasis toward smart phones with more features.

Jha told analysts on a conference call that the phone division is at the beginning of that transition and “we have a lot of work ahead of us.”

Motorola said the improving results from the cell phone division means that it’s making progress toward its long-term goal plans to split off the business. Those plans were put on hold in 2008, as sales kept cratering. It doesn’t yet have a new target date.

In the fourth quarter, Motorola earned $142 million, or 6 cents per share, compared to a loss of $3.66 billion, or $1.61 per share, in the same period a year earlier. That loss was driven by a huge accounting charge.

Excluding unusual items, earnings in the most recent quarter were 9 cents per share. That was a penny higher than the average forecast from analysts, who typically exclude one-time charges from their estimates.

Motorola cut nearly 11,000 jobs last year, or 17 percent of the work force, as it hurried to reduce costs in the face of shrinking sales. Co-CEO Greg Brown said most of the expense slashing is now over.

“Obviously, the heavy lifting was done in 2009, by reducing the cost structure almost $2 billion” per year, Brown said.

With overall sales of 12 million phones, Motorola has again lost its place as the world’s fourth-largest maker to Sony Ericsson, which sold 14.6 million phones in the fourth quarter. Nokia Corp., LG Electronics Inc. and Samsung Electronics Co. all sell more.

For the full year, Motorola lost $51 million, or 5 cents per share, on revenue of $22 billion. That compares to a loss of $4.2 billion, or $1.87 per share, in 2008, as it took big charges to account for the falling value of the cell phone business. Revenue in 2008 was $30.1 billion.

(This version CORRECTS percentage of jobs cut)

Tags: Expense, New York, North America, United States