US tech earnings drive world stock markets higher ahead of US inflation data

By Pan Pylas, APFriday, September 17, 2010

US tech earnings drive world markets higher

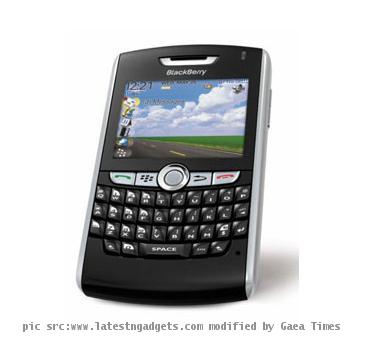

LONDON — World stock markets mostly rose Friday as positive earnings news from technology companies such as Oracle and BlackBerry maker Research in Motion helped shore up sentiment.

Figures showing that U.S. consumer prices rose 0.3 percent in August — roughly in line with expectations — had little impact on the markets on a day when trading is likely to be volatile given that many futures and options contracts have to be settled in both Europe and the U.S.

In Europe, the FTSE 100 index of leading British shares was up 9.67 points, or 0.2 percent, at 5,549.81 while Germany’s DAX rose less than a point to 6,250.55. The CAC-4o in France was up 4.60 points, or 0.1 percent, at 3,740.90.

Wall Street was also poised for a solid opening — Dow futures were up 30 points, or 0.3 percent, to 10,580 while the broader Standard & Poor’s 500 futures rose 2.9 points, or 0.3 percent, to 1,125.50.

Sentiment has been supported by better than expected earnings figures Thursday from the likes of Oracle Corp., the world’s second biggest software company, and Research in Motion Ltd., the maker of BlackBerry handsets.

The technology sector is widely seen as a bellwether of the recovery, as companies’ and households’ demand for new technology rises as the economic outlook brightens.

“Earnings news from the tech sector also beat expectations helping add to the upside,” said Ben Potter, a market strategist at IG Markets.

Over the past week or so, stocks have rebounded as fears of a return to recession in the U.S. — the so-called ‘double-dip’ — have diminished after a run of solid economic data. However, the prevailing view is that the recovery will continue to be fairly subdued that may require further action from policymakers, both in government and at the U.S. Federal Reserve.

The U.S. inflation data are unlikely to convince the Fed of the need to boost money supply by buying bonds from financial institutions.

“Today’s inflation report indicates that the Fed’s monetary policy is unlikely to change in the foreseeable future due to the absence of inflationary or deflationary pressures,” said Michael Woolfolk, an analyst at Bank of New York Mellon.

There will also be interest in the University of Michigan’s preliminary estimate of U.S. consumer sentiment in September. Here, the consensus is that the main index rebounded to 70 from August’s 68.9. Even if the expected rise materializes, the index will still be way below the long-run average of 86.3.

“With an unemployment rate of 9.6 percent, who can blame them?” said Rabobank International analyst Philip Marey.

Earlier in Asia, Japan’s benchmark Nikkei 225 stock average gained 116.59 points, or 1.2 percent, to 9,626.09 as exporters continued to move higher in the wake of the Bank of Japan’s decision earlier this week to intervene directly in the currency markets to stem the export-sapping appreciation of the yen.

By mid afternoon London time, the dollar was unchanged on the day at 85.80 yen, way up from the 82.87 yen 15-year low it was trading at before the intervention.

One side-effect of the intervention has been a strengthening in the euro against the dollar. The euro was down 0.2 percent at $1.3053, having earlier hit a five week high of $1.3159.

Analysts said that Japan’s defense of its currency, its first intervention in six years, has made the euro a favorite bet with traders against the dollar.

Elsewhere in Asia, South Korea’s Kospi rose 0.9 percent to 1,827.35, Hong Kong’s Hang Seng added 1.3 percent to 21,970.86 and Australia’s S&P/ASX 200 advanced 0.7 percent to 4,638.90.

Benchmark crude for October delivery was up 1 cent at $74.58 a barrel in electronic trading on the New York Mercantile Exchange. The contract lost $1.45 to settle at $74.57 a barrel on Thursday.

____

Associated Press Writer Alex Kennedy in Singapore contributed to this report.

Tags: Asia, East Asia, England, Europe, Japan, London, North America, Prices, United Kingdom, United States, Western Europe, World-markets

Elektroauto